Over the past six months, more and more of our clients have started asking the same question:

“Why am I sitting on this much equity and getting this little return?”

When you actually sit down and run the ROE (return on equity) numbers, a lot of properties that felt like winners turn out to be dead weight. Maybe they made sense five years ago, but with today’s interest rates, rising costs, and flat rents... they’re just not performing.

That’s why we’ve seen a surge in 1031 exchanges lately—especially among folks trading up into 5+ unit buildings.

BUT... WHY NOW?

The small commercial space is showing signs of real opportunity. Sellers are more flexible. Lenders are being cautious and no longer underwriting pie-in-the-sky proformas. That creates room for smart buyers who are ready to move fast with real capital.

And when you combine that with a 1031 exchange? You can sell a low-yield property, avoid the tax hit, and roll those gains into something that actually cash flows.

THREE WAYS WE'RE HELPING OUR CLIENTS DO THIS:

Standard Delayed Exchange

The go-to for most investors.

You sell your current property, then identify a replacement within 45 days and close within 180.

Timing is everything—success depends on having the next move lined up before your old property closes.

Reverse Exchange

You put your next property under contract first, usually contingent on the sale of your current one.

Then you execute a double close, selling one and buying the other in quick succession.

It’s more complex, but it gives you control when good deals are rare.

Hybrid Approach

We’re seeing a growing number of clients try to buy and sell within the 45-day identification window. This reduces your exposure to missing the deadline and gives you more flexibility to walk away if the numbers don’t pencil.

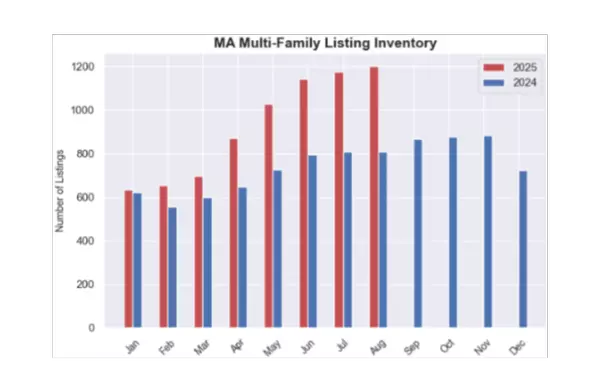

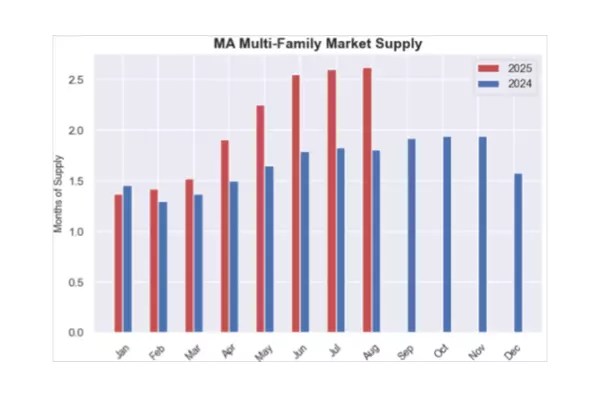

MULTI-FAMILY INVENTORY

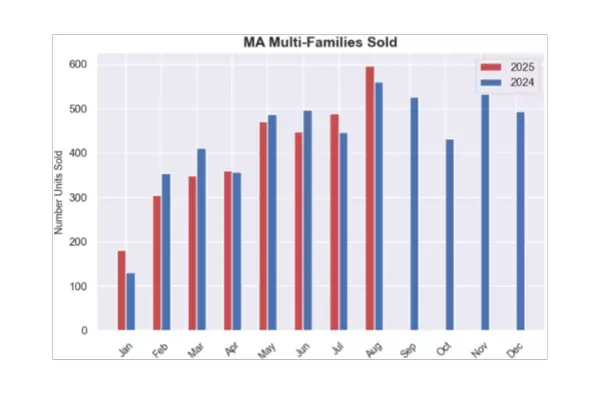

MULTI-FAMILY SOLD

HOW CANDOR HELPS

We can help run the actual ROE math with you to see if it’s time to move

We help line up qualified replacement properties that match your goals

We coordinate the sale, purchase, legal, and lender team under one roof

We stay with you post-close to ensure your new property performs

UNLOCK YOUR PROPERTY'S

FULL POTENCIAL

If you’re holding a property that’s grown in value but doesn’t cash flow, let’s take a look.

You might be one trade away from a better return, better lifestyle, and better long-term position.

Reply to this email or grab 15 minutes on our calendar.

No pressure, just clarity.

QUATERLY MEETUP 3:

FUNDING & DISPOSITION

Unlock the strategies to raise capital and close deals—fast. Join our co-founders Jon Bombaci, Andrew Bosco & Andrew Freed this Sept 25 for a power-packed day of expert insights, real estate funding tactics, and high-level networking.

Be in the room where deals get done.

LISTINGS

Listed by Candor Realty Group of Four Points Real Estate, LLC

Listed by Candor Realty Group of Four Points Real Estate, LLC

Listed by Candor Realty Group of Four Points Real Estate, LLC

Listed by Candor Realty Group of Four Points Real Estate, LLC

Listed by Candor Realty Group of Four Points Real Estate, LLC

Listed by Candor Realty Group of Four Points Real Estate, LLC