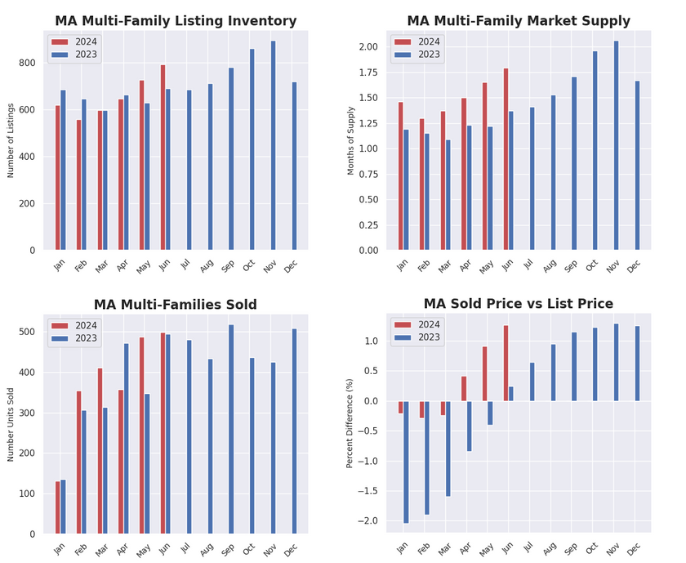

MLS Multi-Family Market Data as of June 15th 2024

We are keeping an eye on the multi-family inventory in MA very closely and also monitoring the average sale price vs list price so we can provide better guidance to our clients. If we see a sharp increase in inventory this will be a good forward-looking indicator that prices may start to soften. Average multi-family listing prices continue to be at an ALL TIME HIGH. However, based on what we see with very low inventory on the market we do not see any indicators in the data to suggest the market will be changing in a significant way in the short-term.

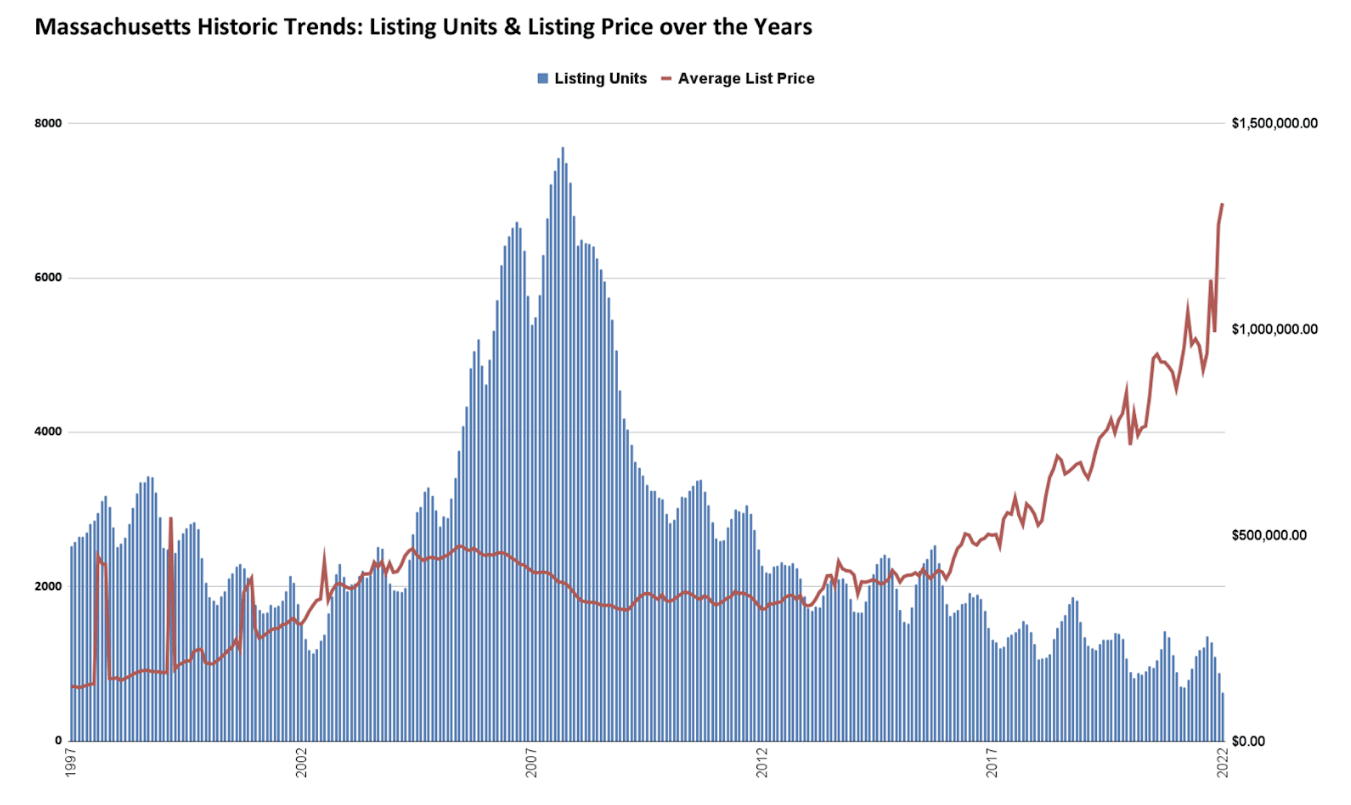

The Massachusetts Multi-Family Market has seen quite a few changes over the last 20+ years. The number of Listings, or Active Inventory, is very low compared to prior years which is driving this very strong seller’s market over the last few years. This shortage of inventory is driving the average listing price significantly upward. As you can see, we are at an all time high, in terms of average multi-family listing price. This is being driven up by the rapid recovery we saw in Greater Boston market as the impacts of Covid started to taper off.

Boston, with its high prices, drives the majority of the MA real estate market averages at a state level. When Covid hit, the prices in Boston were impacted while the suburbs, 30+ minutes outside of Boston, continued to appreciate. Values have bounced back making this the most expensive MA multi-family real estate market of all time.

*Source: www.engineerrealestate.com